What insurance do you need for a golf cart?

3 rows · Jul 04, 2021 · How much is golf cart insurance? Your golf cart insurance cost will vary by insurer ...

Is my golf cart covered under my homeowners policy?

How Much is Golf Cart Insurance? The most recent estimates on golf cart insurance include policy coverage as little as $50 per year when adding a golf cart endorsement to homeowner’s insurance . However, you can also pay $12 per month for a standalone golf cart policy, when the cart is used to drive on a golf course or in a retirement community.

Is my golf cart covered by homeowners insurance?

Golf cart insurance rates vary based on the coverages you select and the make and model of your golf cart. Your age and driving history also factor into the price. Quote golf cart insurance online and see how affordable it can be. Policies start as low as $75/annually. *.

Does homeowners insurance cover golf carts?

The most recent estimates on golf cart insurance include policy coverage as little as $50 per year when adding a golf cart endorsement to homeowner's insurance. However, you can also pay $12 per month for a standalone golf cart policy, when the cart is used to drive on a golf course or in a retirement community.

How much does it cost to insure a street legal golf cart in Florida?

If your golf cart is not registered with the FL DMV, you should be able to cover your Golf Cart with a simple endorsement to your home insurance or a stand-alone Golf Cart insurance policy. The cost of both options is relatively small (usually between $70-$150 per year), but I'd strongly suggest the stand-alone policy.

How long do golf carts last?

For example, some experts estimate that the average golf cart has a useful life range of about 5-7 years. That said, golf carts can still be used for 10 years or more depending on how well they are maintained and how much money a buyer wants to put into their vehicle.

Do golf carts need to be insured in Florida?

Florida. Golf carts are not required to be titled, registered or insured in Florida. Golf carts can be driven on roads that are designated for golf carts with a posted speed limit of 30 mph or less.Feb 4, 2021

Do golf carts hold their value?

Essentially, the golf cart market is flexible, and it allows owners to flip their old cart for a new one without affecting their bank. A product that is accepted by the majority in a market will hold its value because there will always be someone interested in buying what you have.

How much does it cost to replace golf cart batteries?

around $800 to $2000Pricing on batteries varies depending on the voltage, the brand, and the store you bought it from. If you want to replace your battery, you should budget around $800 to $2000.

Do gas or electric golf carts last longer?

Reliability: Both carts are very reliable, but newer electrics do generally last longer than gas. On an electric cart, there are fewer parts and therefore fewer parts to go bad. with a gas cart, you have clutches, carb, fuel pump, belts, valves, starter and more.

Can I drive my golf cart on the street in Florida?

Where You Are Allowed to Drive Golf Carts and LSVs. One thing that both golf carts and LSVs have in common is the ability to drive them in residential neighborhoods. However, an LSV may also operate on any public road with a speed limit no higher than 35 miles per hour.

Do golf carts have titles in Florida?

Golf carts are not required to be titled or registered and, therefore, are not required to be insured with PIP and PDL insurance coverage. Golf cart operators are not required to have a driver license; however, to operate a golf cart on designated public roadways, a person must be 14 years or older.

What does it take to make a golf cart street legal in Florida?

There are several features required for LSV and NEV electric vehicles or street legal golf carts in Florida, including:Stop lamps, turn signal lamps, headlamps, tail lamps, parking brakes.Rearview mirrors, reflex reflectors, windshields, seat belts, and VIN's.More items...

How long will a 48v golf cart run?

How Long Will a 48 Volt Golf Cart Run? A 48 volt golf cart, depending on its amperage can go from 12 miles to 35 miles.

How much is a 2 seater golf cart?

The average 2 seater costs between $7,000 and $8,000. 4 seaters are going to be between $8,000 and $10,000, and 6 seaters run around $10,000 and $13,000.Apr 16, 2020

Is there a Kelley Blue Book for golf carts?

There's No Kelley Blue Book for Golf Carts Kelley Blue Book is focused almost exclusively on automobiles, such as cars, trucks, and vans, and does not have a branch for golf carts. That's because used golf carts are often more diverse and hard to price than cars.

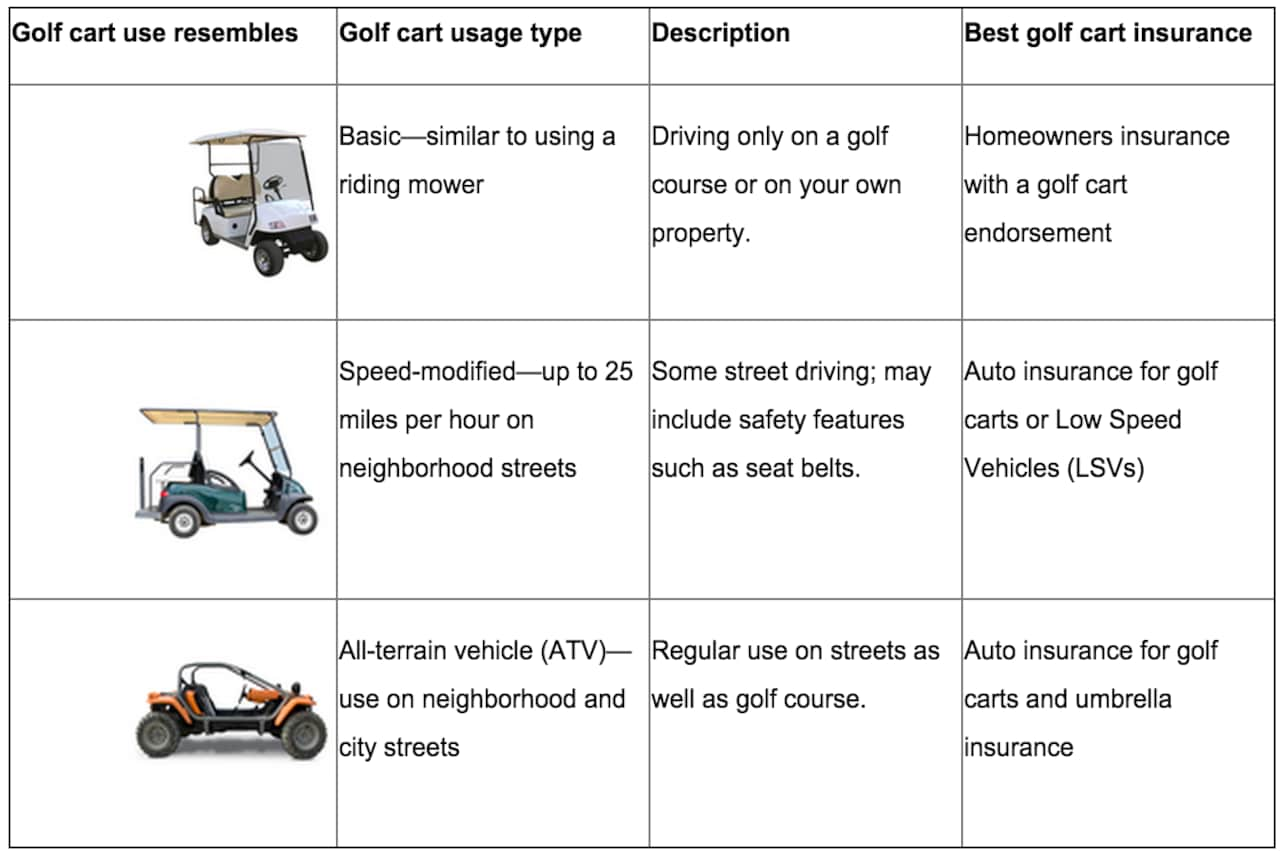

Golf Cart Use: Insurance Implications

Larry Payton of Farmers Insurance in Incline Village, Nevada, says the two most common golf cart insurance questions are: 1. "Do I need golf cart i...

How to Save on Golf Cart Insurance

Call Insurance.com at (855) 430-7750 and let one of our licensed agents guide you through the process of bundling and discounts. Potential discount...

Golf Cart Insurance Rates

How much does it cost to insure my golf cart? It is virtually impossible to compare golf cart insurance premiums by state, because there is no stan...

Basic Golf Cart Usage—Insurance Considerations

Basic golf cart usage is similar to driving a riding mower; it's probably covered under your homeowner's policy. A riding mower doesn't have to be...

Speed-Modified: Auto Insurance With Golf Cart Endorsement

Most golf carts are designed to operate at about 15 miles per hour. For this reason, golf carts are not required to have the safety features that w...

The Golf Cart as Atv—Auto and Umbrella Insurance

If you drive your golf cart to and from the club when you play, or tool around a private golf or retirement community, you need insurance coverage...

Golf Cart Accidents and Insurance Coverage

Determining which insurance coverage applies in the case of a golf cart mishap can be confusing. The table below summarizes various circumstances w...

How Much is Golf Cart Insurance?

The most recent estimates on golf cart insurance include policy coverage as little as $50 per year when adding a golf cart endorsement to homeowner’s insurance.

Paying for Low-Speed Vehicle Insurance

People who upgrade their golf cart to a low-speed vehicle have to put in a lot of work to make them drivable.

Types of Coverage You May Get

There are many types of insurance policies you may want to get for your golf cart.

What does comprehensive cover on a golf cart?

Additionally, comprehensive covers damage from a fire, hitting an animal, an act of nature or glass breakage.

What is an uninsured motorist?

Uninsured/underinsured motorist bodily injury and property damage. Covers you and any passengers while riding in your golf cart if you’re injured by another driver with no insurance or not enough insurance. You’re also covered if an uninsured or underinsured driver damages your golf cart.

Does golf cart insurance cover property damage?

Bodily injury and property damage liability. Although not required in every state, golf cart liability insurance can protect you if you’re liable because you injured someone or damaged their property while riding your golf cart. Your court costs and legal fees are also covered up to your policy’s limits.

How Much Is Golf Cart Insurance? (Cost, Types Of Coverage)

The most recent estimates on golf cart insurance include policy coverage as little as $50 per year when adding a golf cart endorsement to homeowner's insurance. However, you can also pay $12 per month for a standalone golf cart policy, when the cart is used to drive on a golf course or in a retirement community. More ›

Golf Cart Insurance - Nationwide

Some golf carts are eligible for coverage under a homeowners insurance policy, as long as you stay on your property.Others are eligible for some coverage as part of an auto insurance policy.. However, the best way to protect your golf cart is with an insurance policy than can be specially tailored for it. More ›

How Much is Golf Cart Insurance (LSV) in New Jersey ..

The new generation of street legal golf carts and other types of Low Speed Vehicles (LSV) are ultra-convenient, simple to drive, environmentally friendly, and able to adapt to a wide variety of terrain and situations. As LSVs become more popular, independent insurance agents are often asked about the cost of golf cart insurance in New Jersey ...

How Much is a Golf Cart Cost (Update 2021)

How Much Does a Golf Cart Cost: FAQs What is the average cost of golf cart insurance? There are many kinds of insurance policies depends on coverage, cart model, and use type. Golf cart insurance cost differs mainly based on the coverage. You can avail of an Insurance policy for your basic golf cart as low as USD 50.00 (fifty) per year. More ›

The Cost of Golf Carts - in 2022 - The Pricer

Just How Much Do Used Golf Carts Cost? Used golf carts, usually, will cost around $5,000 to $6,000. The bright side about looking for a used golf cart is that they are pretty easy to find. There are a wide variety of used golf carts readily available, mainly because golf courses have to renew their golf cart fleets every couple of years. More ›

How Much A Golf Cart Costs (10 Example Golf Carts) 2021 ..

How Much A Golf Cart Costs (10 Example Golf Carts) 2021 Updated Golf carts provide a variety of unique benefits that go beyond the golf range. For example, you can use a cart to move across a large piece of property quickly and efficiently. ou can also use one to have fun with your friends or even take one to a golf course if they allow it. More ›

How Much Does A Golf Cart Cost? Our 2022 Golf Cart Price Guide

Electric vs. Gas Golf Cart Cost. So, how much is an electric golf cart compared to a gas golf cart? Electric golf carts cost an average of 6% more than gas golf carts, usually representing a difference of between $300-$700 more depending on the make and model of the golf cart you're selecting. More ›

What states require golf cart insurance?

These would be Arkansas, Delaware, Florida, Hawaii, Kansas, Kentucky, Massachusetts, Maryland, Michigan, Minnesota, New Jersey, New York, North Dakota, Oregon, Pennsylvania, South Dakota, Texas, Utah, Virginia, Washington and the District of Columbia.

Do you need special insurance for a cart?

You don’t need a special insurance policy for that, but a quick call to your insurance company could clear up that question quickly. On the other hand, you might have a cart that’s intended use is for your residential community, which would usually be a gated homeowner’s association. If this is the case, your insurance agent will want to know ...

Why is it important to have insurance for a golf cart?

Having golf cart insurance is important, because it helps protect you from these kinds of risks. How you use your golf cart affects how much coverage you need. Depending on how you use it, consider these coverages for your golf cart insurance.

What factors affect golf cart insurance?

Other factors that can impact your golf cart insurance cost are your: Vehicle’s size. Driving history.

What is a basic golf cart?

Basic golf cart: Helps protect your golf cart if you only drive it on a course. You can add this endorsement to your homeowners insurance policy. ATV golf cart: Using a modified golf cart at the golf course or off road requires more coverage.

Do you need liability insurance for a golf cart in Arizona?

For example, Arizona drivers need to carry liability insurance if they drive their golf cart on the road. Depending on where you live, your state may have different insurance requirements. These laws vary by state, so it’s a good idea to make sure you get the right coverage.

Why are golf carts so popular?

Golf carts and low speed vehicles (LSVs) are growing in popularity because they are convenient, relatively easy to operate, and versatile.

What is discount insurance?

1 Discounts and savings are available where state laws and regulations allow, and may vary by state. Certain discounts apply to specific coverages only. To the extent permitted by law, applicants are individually underwritten; not all applicants may qualify. 2 Optional coverage.

Does golf cart insurance cover spouse?

This covers medical expenses for a passenger injured while riding with you in your golf cart. This does not include your spouse, who is already protected under your medical coverage.

Does homeowners insurance cover golf carts?

Your homeowners policy may give you some coverage for use of a golf cart, but it's very limited and there are many common situations that could leave you without protection. For example, many homeowners policies won' t cover you when you drive to a neighbor's house, which is a typical use for these types of vehicles.

Can you get stranded in a golf cart accident?

But with Roadside Assistance, you won’t get stranded in the event of a breakdown, flat, or any other covered incident that requires emergency assistance or a tow.

What is golf cart insurance?

Here's a look at how each coverage in a golf cart insurance policy works: Property damage liability. If you are found legally responsible for an accident where your golf cart damaged another person's property — their car or house, for instance — this coverage may help you pay to repair the damage. Bodily injury liability.

What is a limit on a golf cart?

A limit is the maximum amount your policy will pay toward a covered claim. You may also need to pay your deductible, which is your share of a covered claim. Some people mistakenly assume that their existing insurance will help cover a golf cart.

Does Allstate cover golf cart damage?

These coverages may help pay to repair damage to your golf cart in certain situations. They may also help cover your expenses if you cause an accident that injures another person or damages their property. COUNT ON QUALITY COVERAGE. Get the protection you need and the peace of mind you deserve with Allstate insurance.

Can you increase liability on a golf cart?

And, you may be able to increase your liability coverage limits above what's provided by a golf cart policy if you purchase a separate umbrella insurance policy . As with any insurance policy, cover age limits will apply. A limit is the maximum amount your policy will pay toward a covered claim. You may also need to pay your deductible, which is ...

Do you insure a golf cart?

You insure your golf cart with the same company that insures your home or car. Ask your agent about a multiple policy, or "bundling," discount. You're a homeowner. You take advantage of payment options — for example paying for your policy in a lump sum, rather than with multiple payments.

Do you need to have liability insurance for a golf cart in Arizona?

In Arizona, for instance, golf cart owners are required by law to have liability insurance if they use the vehicle on roads. So, be sure to check your state's laws to help determine if golf cart insurance is required where you live. Even if you're not legally required to buy golf cart insurance, it may make sense for you to do so.

What is a golf cart?

Golf carts offer a flexible transportation solution for golf courses and other properties or areas that aren’t suitable for automobile traffic. These compact, maneuverable vehicles are ideal for moving people and a small amount of equipment or materials quickly and efficiently.

What happens if you get in an accident with a golf cart?

When an accident with a golf cart you own or rent occurs, you could be liable for injuries or damages resulting from the incident. Without adequate liability insurance coverage, you could have to pay a substantial sum to settle a claim or lawsuit. It’s even possible you could lose some or all of your business or personal assets.

What is a PD in golf cart insurance?

Physical Damage (PD): Use this non-liability insurance option to compensate you for losses or damages to golf carts that you own. PD coverage can include collision — crashing into another cart or an object such as a tree — and comprehensive — non-accident-related damage such as theft, vandalism, fire, lightning, and wind.

What does GL cover?

It also pays for the insured’s legal defense. Lastly, GL covers property damage – if you cause an accident that damages others’ property, this insurance pays for repairs or replacements and provides lawsuit protection. Physical Damage (PD): Use this non-liability insurance option to compensate you for losses or damages to golf carts that you own.

Do you need insurance for a golf cart?

Whether you have a golf cart rental service, a rental home with a golf cart, a golf cart taxi service, or are advertising with a golf cart, insurance coverage is a must. Golf carts are used all over the place including neighborhoods, college campuses, senior communities, and airports, and many accidents involving golf carts require emergency room ...

How do I insure a golf cart?

Quick Answer List: Should I insure my golf cart? 1 Home or auto insurance may cover a standard cart not licensed for use on a public road. 2 If the cart has modified speed, a separate mini auto or golf cart policy may be required. 3 Golf cart coverage is required in some states. 4 Even if you only use your cart at a club, home or auto coverage may not be sufficient for every hazard you face.

Do you need a specialty policy for a golf cart?

If you have a golf cart model with a speed modification, or one that you have licensed for use on a public road—such as driving around a neighborhood—then you may need a specialty policy for low speed vehicles. In fact, your state may require your cart to be insured like a traditional auto, not to mention any community clubs or homeowner ...

Does home insurance cover a golf cart?

Home or auto insurance may cover a standard cart not licensed for use on a public road. If the cart has modified speed, a separate mini auto or golf cart policy may be required. Golf cart coverage is required in some states.