You can offset some costs by selling hole sponsorships to local businesses or individuals. The Illinois Parks and Recreation Department notes that golf outing organizers may charge $100 to more than $1,000 for a hole sponsorship, depending on the event. Course Selection Choosing a golf course should be one of the first items on your checklist.

Full Answer

How much does it cost to advertise a golf outing?

For example, most golf outings have package advertising opportunities that include golfer registrations. You may pay $1,200 for an advertising sign on the fourth tee that also entitles you to a group for the golf event. This raises a lot of issues, such as:

What makes a successful golf outing?

A truly successful golf event creates valuable experiences for all of its varied audiences. Planning a golf outing is like few other events. It's part golf tournament and part gala and requires a tremendous amount of organization and planning, so having strong partners is critical.

How to plan a successful golf event budget?

One important reminder is to account for all your projected expenses before you set your costs for playing or sponsoring your golf event budget. This will help you achieve your financial objectives. Perfect Golf Event helps thousands of event organizers plan and promote their fundraising golf event budget.

Where can I find help organizing a golf outing?

Hazeltine offers a complete guide for organizing a successful golf outing. Whether you're planning your first event, or you're an old pro, you'll find helpful information here.

Can you expense a golf outing?

Allowed To Deduct Golf Expenses? With regard to golf, you can deduct golf green fees, guest fees, cart fees, caddies, tees, balls & gloves, beverages, snacks, breakfast, lunch or dinner. And, you can deduct your own costs, even if you go Dutch & pay only for yourself.

Can I deduct golf with a client?

2022 meals and entertainment deduction As part of the Consolidated Appropriations Act signed into law on December 27, 2020, the deductibility of meals is changing. Food and beverages will be 100% deductible if purchased from a restaurant in 2021 and 2022. Entertaining clients (concert tickets, golf games, etc.)

Are business golf outings tax deductible?

Unlike most entertainment that suffers a 50 percent cut in deductions and faces other limits, golfers can qualify for a 100 percent entertainment deduction when they play in, or are a spectator at, a qualified charity event. The events can be large PGA TOUR events or local school golf outings. Both are tax advantaged.

How do you write off golf?

The basic rule for deducting golf and other entertainment costs is that the entertainment or “fun” has to follow or precede a legitimate business discussion. Key there is legitimate business. It follows the same basic rule for deducting meals, which it turns out are the key to this whole deducting golf thing.

Is golf considered entertainment?

Golf does qualify for a deduction as associated entertainment when you have the right business discussion in a valid business setting before or after the golf, generally the same day. Editor's Update: Directly-related entertainment is deductible prior to January 1, 2018.

Is golf a business expense 2021?

The Tax Cuts and Jobs Act (TCJA) permanently eliminated deductions for most business-related entertainment expenses paid or incurred after 2017. For example, you can no longer deduct any of the cost of taking clients out for a round of golf, to the theater or for a football game.

Is golf membership a business expense?

Under the new rules, any membership dues paid to a club for business, leisure, recreation, country club or other social purposes are 100% non-deductible, unless they are included as compensation on an employee's Form W-2.

Is a country club membership a business expense?

No. But there is a small silver lining. The IRS in Publication 463 (Travel, Entertainment, Gift and Car Expenses) is very specific regarding deducting club dues and membership fees. Any club that is organized for pleasure, recreation OR other social purposes is not a deductible expense.

Can golf lessons be a business expense?

Because you're an avid reader of our articles, you'll know that you can deduct a portion of the $900 that's attributable to the business rounds of golf you play. In other words, you can deduct $675, or 75%, of the cost of your golf lessons.

Can you write off green fees?

When it comes to golf course green fees, the rules are very clear. Golf is considered a recreational activity and therefore the expenses related to that activity are not tax deductible.

Can you write off entertainment expenses?

For costs paid or incurred during the 2021 and 2022 calendar years, businesses may claim a deduction for 100% of the cost of meals provided by a restaurant. The temporarily enhanced deduction doesn't apply to entertainment, which remains a disallowed deduction.

When to have a business discussion on golf course?

Your business discussion can take place directly before or after hitting the golf course, but it must occur reasonably close in time to the business-setting business discussion. This is an ideal time to do your business discussions over breakfast, lunch or dinner.

Can you talk business while playing golf?

Even if you actually are talking business while playing, you likely cannot use that nonbusiness-setting discussion to qualify your entertainment expenses. But, there is a simple solution. Move the business discussion to a “business setting” shortly before or after your golf game.

Can you deduct golf expenses?

Can you deduct golf expenses when you’re a business owner? Yes. But, it isn’t quite as straight forward as other entertainment expenses. That’s because the IRS assumes that any discussions with your fellow golfers while on the course is never business-related. Even if you actually are talking business while playing, you likely cannot use that nonbusiness-setting discussion to qualify your entertainment expenses. But, there is a simple solution. Move the business discussion to a “business setting” shortly before or after your golf game.

What is the most important purchase a golfer will make in his lifetime?

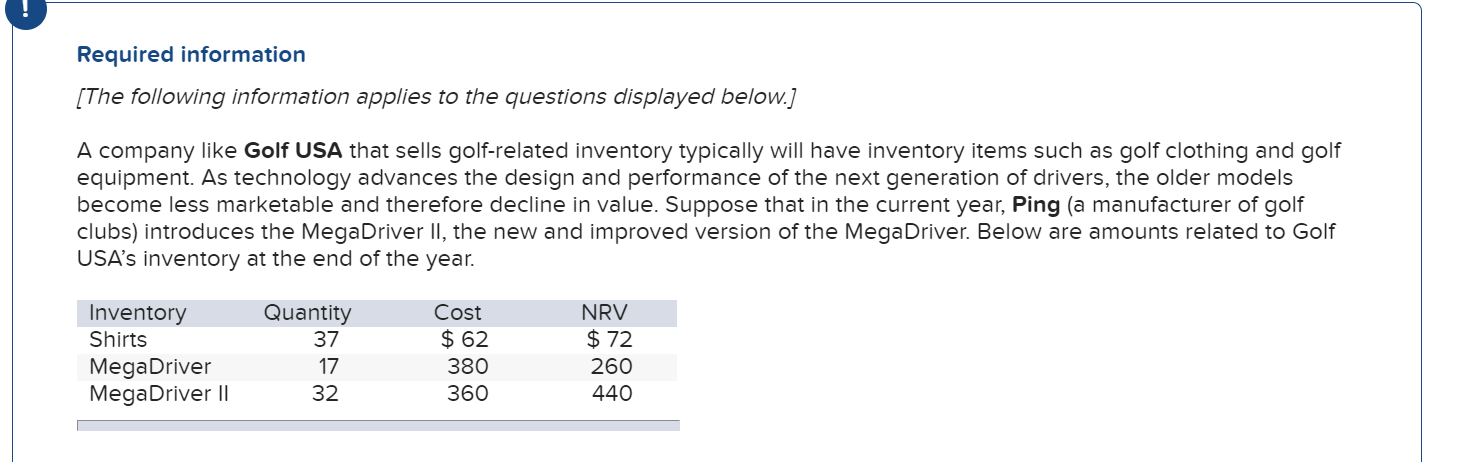

One of the most important purchases a golfer will make in his lifetime is when he/she picks out a new (or first) set of irons. Unfortunately, this will also be one of the more expensive investments you make towards your golf game.

How much are golf gloves?

Golf gloves are golf gloves no matter what brand they are. Some name brand golf gloves like Titliest or Ping or Puma provide golf glove options that can get over $25 starting price.

What are some good accessories for golf?

One of the most underrated accessories for golf is a good pair of sunglasses. Golf is an outdoor sport and the sunshine is one of the most enjoyable parts of the experience. Having a nice pair of sunglasses can make a huge difference during the golf round, especially when you're trying to track your golf ball in the air.

Where to go on a golf vacation?

It's great to experience a different city and the golf courses that they have, while also having time to sit, drink and chat with your golf buddies. Some of the best places to have a golf vacation include Las Vegas, Dallas, Arizona, and just about anywhere in Florida. But even if you're just doing a staycation in your own city, there's just something magical about a golf vacation so please start planning one now.

Can putters be unnecessary?

While expensive putters can be unnecessary, new drivers on the other hand can really make a difference in your golf game. While the confidence analogy above still rings true here, there are fundamental differences in the design of drivers than there are with putters.

Do golf gloves rip open?

Not only is the glove sure to rip open at some part if you play and practice a lot, but you won't notice an actual difference in grip or comfort between most name brand golf gloves and non-name brand gloves. Just stick to the cheap ones as they will all fall apart quickly anyways.

Is golf clothing expensive?

Golf clothing can be very expensive depending on the brands and styles that are you looking for, but you don't have to break the bank for a normal golf outfit that would be acceptable at most courses. It's not a fashion show.

Is golf food tax deductible?

One upside is any meals associated with entertainment activities are still 50% deductible. For example, if a business owner takes a group of clients golfing, the cost of the greens fees would not be deductible, but food and beverages purchased before, during or after the round of golf, will still be 50 percent deductible.

Is golfing a business expense?

That Golf Outing? It’s No Longer a Deductible Business Entertainment Expense

Do entertainment and meal expenses have to be recorded together?

Because the tax treatment was the same, most businesses had their meals and entertainment expenses recorded together in the same general ledger account. However, beginning in 2018 under the new law, meal expenses and entertainment expenses are no longer treated the same.

Is golf expense deductible on a general ledger?

Because of these new tax rules, every business should set up separate accounts in their general ledger account to record entertainment costs, which are non-deductible. This account would include expenses for golf outings, sporting events, fishing trips, etc. Another account would be needed for meals that are 50% deductible. Remember to separate out meals that are part of any employee travel, client entertainment, or for the convenience of the employer. Another separate account will be needed for the “office holiday party” expenses for employees.

Can you deduct entertainment expenses for meals?

The tax reform act not only changes the entertainment expenses deduction mentioned above, the act also changes the rules regarding the deductions for meals provided for the convenience of your employees. In 2017 and prior years, meals provided to employees in your office or other work location were considered to be for the convenience of the employer and therefore were 100% deductible. An example is when dinner is provided to employees working after quitting time in order to complete a project or meet a customer deadline. Under the old rules, these meal expenses were deductible 100%, and the business would have recorded them in a separate account in their general ledger.

Is entertainment expense deductible?

As part of the tax reform changes, beginning in 2018 expenses for entertainment expenses are no longer deductible. Under the old rules, entertainment expenses and most meal expenses were 50 percent deductible. Because the tax treatment was the same, most businesses had their meals and entertainment expenses recorded together in ...

Do you separate meals from travel expenses?

Remember to separate out meals that are part of any employee travel, client entertainment, or for the convenience of the employer. Another separate account will be needed for the “office holiday party” expenses for employees.

How much does it cost to advertise on the fourth tee?

For example, most golf outings have package advertising opportunities that include golfer registrations. You may pay $1,200 for an advertising sign on the fourth tee that also entitles you to a group for the golf event. This raises a lot of issues, such as:

How to get rid of 1000 expense?

There are a few different ways you can get this right in your books The best way to do this is to write a personal check to reimburse your business for the $1000. This will eliminate the $1000 expense your business incurred.

What line is the $300 contribution on a C corporation?

Your C Corporation can deduct the $300 charitable contribution on line 19 of its Form 1120, subject to a 120 percent of modified taxable income limitation. The nondeductible $700 is a Schedule M-1 book-to-tax adjustment.

When did the 100 percent deduction for sporting events come into effect?

To remove this from the tax code, the lawmakers had to remove two specific tax code sections that were put in place in the Tax Reform Act of 1986 to specifically authorize 100 percent deductions for special sporting events that benefited charity. In time, we will all find out how this is going to play out.

Is business entertainment tax deductible?

The event was considered a business event not subject to the business entertainment tax deduction (50 percent cut). Further, the deduction is not considered a charitable contribution for tax purposes, and thus you did not have to reduce your deduction under the charitable rules. As of January 1, 2018, this stopped.

Does golf get taxed on charity golf?

The recent tax reform has changed the way you can handle Charity Golf Outings. The tax reform did away with business tax deductions for prospect and client golf.

What is an ordinary expense for golf?

An ordinary expense is defined by the IRS as one that is common and accepted in your industry.

Why is business travel audited?

Note: Business Travel is highly audited because there is a lot of room for manipulation – the most common method is grouping personal travel expenses with business travel expenses.

Is travel to a business conference deductible?

We all understand that expenses related to travel to a business conference is deductible. Mixing business with pleasure comes with additional rules. You may deduct your total travel costs as long as the main purpose of the trip was attending for a business conference. Be sure to spend more days on business than on pleasure.

Is Women on Course event tax deductible?

Even though Women on Course lifestyle events include golf, wine and travel with some networking or educational opportunities for business owners – it would need to be shown that the main purpose is business related. Success Series events which are business workshops would be considered acceptable as tax deductible.

Is golf membership tax deductible?

And now, under new tax reform – a round of golf with a client or prospect is no longer tax deductible at all! In order for membership dues to be deductible, you must own a business, the membership dues must be paid to a professional, business or civic organization AND the organization’s main purpose is NOT to provide entertainment to their members. ...

Is a ticket price deductible?

If the amount of money paid or a ticket is equal to or less than the fair market value of what is received by attending the event, then NONE of the ticket price can be considered a tax-deductible donation.

Do you have to pay entry fees for PGA Tour?

A PGA Tour player who’s exempt from qualifying doesn’t have to pay entry fees for tour events. Most professionals competing in a pre-tournament qualifying event pay entry fees of $400 apiece, except for Champions and Nationwide Tour players ($100 each) and non-exempt PGA Tour members (no entry fee).

Is a sponsorship payment tax deductible?

The value of the goods and services provided in exchange for the sponsorship payment is treated as a separate quid pro quo transaction, and the remaining sponsorship payment is generally tax-deductible as long it is a qualified sponsorship payment.

Can you deduct golf tournaments?

A golf tournament whose net proceeds are donated entirely to charity is eligible to qualify for the 100 percent deduction. Such an event would not fail to qualify solely because it offered prize money to golfers who participated or because it used paid concessionaires or security personnel.

Getting Started

Budget

Sponsorships

Volunteers

Promotion

Tournament Details

Event Experience

Wrap Up

- Say Thanks

A successful golf eventdeserves recognition of all those who made it possible. You'll want to write personal thank you notes to a number of people, including sponsors, participants, committee members, volunteers, and even vendors. A good thank you note includes the impact that individ… - Post-Mortem

The first thing you'll want to do is determine the success of the event. Reconcile any outstanding budget items and summarize the results. Once financials are available, bring your planning committee together to review the results. Talk about what worked well and what you'd like to ch…