Is golf considered an entertainment expense?

Yes. But, it isn’t quite as straight forward as other entertainment expenses. That’s because the IRS assumes that any discussions with your fellow golfers while on the course is never business-related.

Can I deduct golf as a business expense?

I’m not saying you should meet at a library, but in order to be able to deduct golf as a valid business expense, you need to create proof that the location was not on the golf course itself.

Are golf tournament registration expenses tax deductible?

Expenses incurred for using a golf course constitute precisely an expressly forbidden expense. So, taxpayers in business cannot deduct the cost of a round of golf when they invite a client. The same restriction also applies to golf tournament registration costs. Since this expense was incurred to use a golf course, no amounts are deductible.

What is the tax write-off on golf courses?

Originally intended to encourage conservation of agricultural land, the write-off has been a boon to developers and course owners, including President Trump, who, according to a 2016 Wall Street Journal report, deducted $39.1 million from his 2005 federal income taxes by promising not to build homes on Trump National Golf Club in New Jersey.

Can you expense a golf outing?

Allowed To Deduct Golf Expenses? With regard to golf, you can deduct golf green fees, guest fees, cart fees, caddies, tees, balls & gloves, beverages, snacks, breakfast, lunch or dinner. And, you can deduct your own costs, even if you go Dutch & pay only for yourself.

Can you write off golf outing?

Unlike most entertainment that suffers a 50 percent cut in deductions and faces other limits, golfers can qualify for a 100 percent entertainment deduction when they play in, or are a spectator at, a qualified charity event. The events can be large PGA TOUR events or local school golf outings. Both are tax advantaged.

Is golf considered entertainment?

Golf does qualify for a deduction as associated entertainment when you have the right business discussion in a valid business setting before or after the golf, generally the same day. Editor's Update: Directly-related entertainment is deductible prior to January 1, 2018.

Is golf a business expense 2021?

The Tax Cuts and Jobs Act (TCJA) permanently eliminated deductions for most business-related entertainment expenses paid or incurred after 2017. For example, you can no longer deduct any of the cost of taking clients out for a round of golf, to the theater or for a football game.

Can you write off golf as a business expense 2022?

2022 meals and entertainment deduction As part of the Consolidated Appropriations Act signed into law on December 27, 2020, the deductibility of meals is changing. Food and beverages will be 100% deductible if purchased from a restaurant in 2021 and 2022. Entertaining clients (concert tickets, golf games, etc.)

Is golf membership a business expense?

Under the new rules, any membership dues paid to a club for business, leisure, recreation, country club or other social purposes are 100% non-deductible, unless they are included as compensation on an employee's Form W-2.

Are sports tickets a business expense?

“Purchasing tickets to take a business client to a sporting event or other entertainment type event are not deductible.

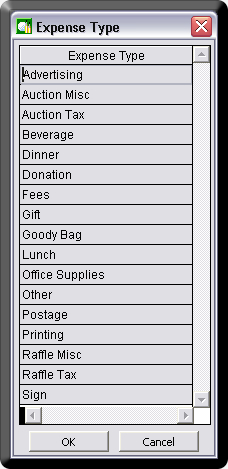

What are business entertainment expenses?

Entertainment expenses include the cost of entertaining customers or employees at social and sports events, restaurant meals and theater tickets, among other things. You may deduct business entertainment expenses subject to certain conditions. First, you or one of your employees must be present.

How do you write off entertainment expenses?

Your business can deduct 100% of the cost of food, beverages, and entertainment sold to customers for full value, including the cost of related facilities. IRS regulations confirm that this exception is still available, and it still covers applicable entertainment expenses.

Can you write off golf cart as a business expense 2020?

You can deduct the cost of a golf cart on Schedule C if you are a self-employed professional golfer, and it is a necessary expense for your business. If you are just a recreational golfer or the golf cart is for other purposes, it is a nondeductible personal expense.

When to have a business discussion on golf course?

Your business discussion can take place directly before or after hitting the golf course, but it must occur reasonably close in time to the business-setting business discussion. This is an ideal time to do your business discussions over breakfast, lunch or dinner.

Can you use non business setting discussion on golf course?

Even if you actually are talking business while playing, you likely cannot use that nonbusiness-setting discussion to qualify your entertainment expenses. But, there is a simple solution.

Can you deduct golf fees?

With regard to golf, you can deduct golf green fees, guest fees, cart fees, caddies, tees, balls & gloves, beverages, snacks, breakfast, lunch or dinner. And, you can deduct your own costs, even if you go Dutch & pay only for yourself.

What percentage of golf business deductions are preserved?

In late November, as the tax bill was taking shape, Karen and representatives from three other golf industry groups penned a letter to Congress, pleading with lawmakers to preserve the 50 percent business-entertainment deduction.

Can you write off half of a golf round?

It applies to a range of activities, including concerts, sporting events and, yes, rounds of golf. After posting your score for 18 holes with a business acquaintance, you can no longer write off half the cost of the round.

Is the PGA Tour a 501c3?

Its actions came in response to an early version of the tax bill, which contained a subsection that would have jeopardized the PGA Tour’s tax-exempt status as a 501 (c) (3) charitable organization. When the Tour got word of the proposed change, Tour commissioner Jay Monahan phoned Jack Nicklaus to enlist his help.

Is the golf industry running out of steam?

In the past few years, the golf industry has been running out of steam. According to data provided by the industry, golf courses may be counting on the same number of members, but these are playing fewer rounds than before. This results in decreased revenues for the golf clubs, which are left to their own devices to find ways ...

Is golf club membership deductible?

Since this expense was incurred to use a golf course, no amounts are deductible. The same treatment applies to annual golf club membership fees. Unfortunately, no portion can be deducted.

Can you deduct golf tickets for business development?

When choosing your business development activities, remember that the tax authorities will allow you to deduct a portion of the cost of a ticket to attend a cultural or sports event (music show, soccer or hockey game, Formula One Grand Prix, etc.), but no amount can be deducted for bringing a client to play golf.

Can you deduct meals from a tournament?

When the cost of meals is included in a tournament’s registration expenses , unfortunately, deductions are not possible. The portion of the cost of the meal is what’s important if you want to benefit from a deduction. Without this information, no portion is deductible.

Is a golf tournament deductible?

Without this information, no portion is deductible. During your company’s annual golf tournament, remember that all expenses incurred by an employer for food, drink or entertainment offered to the employees are not subject to the 50% limit. Rather, they are entirely deductible.

Can you deduct golf expenses?

In general, taxpayers in business can deduct any reasonable expense incurred for earning business income as long as this expense is not expressly forbidden. Expenses incurred for using a golf course constitute precisely an expressly forbidden expense.

What is the difference between necessary and ordinary expenses?

If you are looking at the expenses to attend a golf event, the purpose must be ordinary and necessary for your trade or profession (just like all business expenses). An ordinary expense is defined by the IRS as one that is common and accepted in your industry. A necessary expense is one that is helpful and appropriate for your trade or business.

Why is business travel audited?

Note: Business Travel is highly audited because there is a lot of room for manipulation – the most common method is grouping personal travel expenses with business travel expenses.

Is an excursion a business expense?

The excursion will hold up as a business expense – they are typically seen as a networking meet-and-greet. By Dawn McGruder, CPA, President of The McGruder Group based in Fairfax, VA. She is a Board Member of Women on Course.

Is travel to a business conference deductible?

We all understand that expenses related to travel to a business conference is deductible. Mixing business with pleasure comes with additional rules. You may deduct your total travel costs as long as the main purpose of the trip was attending for a business conference. Be sure to spend more days on business than on pleasure.

Is Women on Course event tax deductible?

Even though Women on Course lifestyle events include golf, wine and travel with some networking or educational opportunities for business owners – it would need to be shown that the main purpose is business related. Success Series events which are business workshops would be considered acceptable as tax deductible.

Is golf membership tax deductible?

And now, under new tax reform – a round of golf with a client or prospect is no longer tax deductible at all! In order for membership dues to be deductible, you must own a business, the membership dues must be paid to a professional, business or civic organization AND the organization’s main purpose is NOT to provide entertainment to their members. ...

Can you deduct green fees?

Even though business may be discussed on the course, and you may have even closed a deal, you cannot deduct the cost of the green fees or membership. When it comes to golf course green fees, the rules are very clear.

Can you deduct golf costs on your taxes?

Therefore, if you take a client out for a round of golf, you cannot deduct the cost of that round in your business for tax purposes.

Is golf a tax deductible activity?

Golf is considered a recreational activity and therefore the expenses related to that activity are not tax deductible. As the entertainment of key clients, suppliers and employees is becoming such an important aspect of doing business, an informal war has developed between taxpayers and the CRA concerning what is considered an acceptable deduction ...

Who does Jack invite to play golf with?

Jack invites Arnie, a competitor, to play golf at his club. Before the golf, the two have lunch together in the clubhouse where they discuss Jack buying Arnie out. Jack pays for the breakfast and the greens fees for the two to play a round of golf together.

When should a business discussion occur?

Ordinarily, the business discussion should occur on the same day as the golf. However, if the people you play golf with are coming from out of town and have to stay overnight, the golf can occur on the day before or day after the discussion.

Is a golf outing deductible?

For example, a box at the ballpark, tickets to a concert, or a golf outing with clients is not deductible. Entertainment expenses for an employee who is traveling on company business are also not deductible. 3 .

Is a box at the ballpark deductible?

What's Deductible/What's Not. Generally, the IRS doesn't allow business to deduct costs for activities generally considered entertainment, amusement, or recreation, or for a facility used in connection with such activity. Taking a client or customer to an "experience" is no longer deductible. For example, a box at the ballpark, tickets ...

Is a business meal deductible?

But business meal costs are still deductible at 50%. So, a businessperson or salesperson can take a client to lunch to discuss business and the meal cost is still deductible. 1 . If you can separate the cost of a meal at an entertainment event and the cost of the event and you have a separate receipt for the meal expense, ...

Can you deduct entertainment expenses on a W-2?

You may deduct entertainment expenses that are compensation to the person, and are reported on Form W-2 for an employee or Form 1099-NEC for an independent contractor. Special deduction rules apply if the recipient is an officer, director, or other special types of business owners. 1

Can you deduct travel expenses for business?

For employees traveling for business purposes, most of their expenses are deductible, including lodging and meals. But you can't deduct entertainment expenses for these employees. An Example: If an employer gives a hotel room or an automobile to an employee who is on vacation, that would be considered as entertainment of the employee, ...

Can you deduct expenses for highly compensated employees?

You may also deduct expenses for some types of events for the benefit of employees, except for highly compensated employees. For example, your company picnic or holiday party for employees can meet the test. A catered meal for employees at your office or elsewhere at your business location for the purpose of presenting employee awards would also ...